Trump’s Trade Policy - The EU response PDF | 4.80 MB

Early into 2025 and the second Trump administration, tariffs are playing a major role in President Trump’s trade policy. The EU has started to react. In this article, we consider the EU response and examine the other options available to it. We also consider the impact on Ireland and businesses operating in Ireland and the steps they can take in the new volatile trade environment.

New era in US trade policy

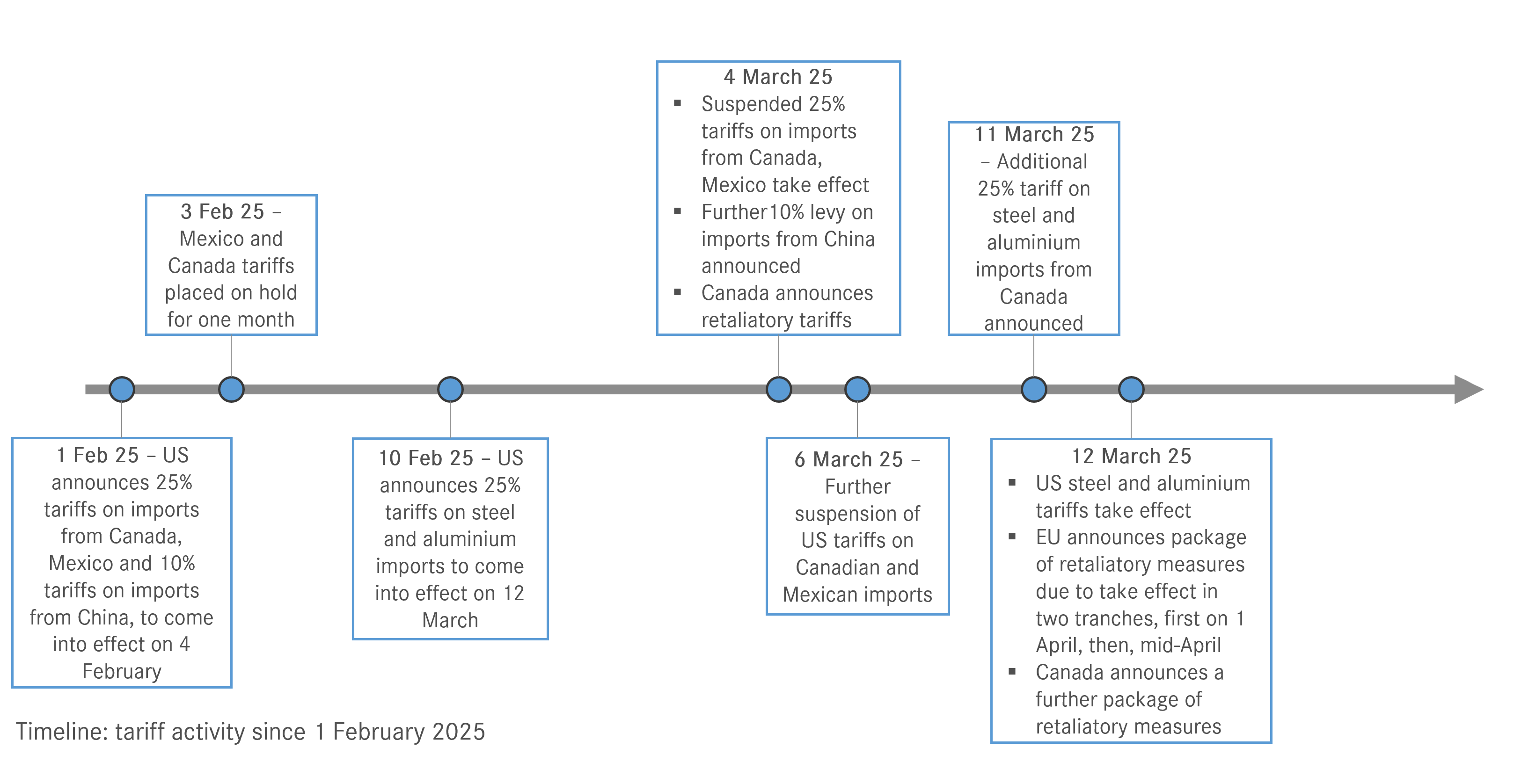

True to his campaign promises, President Trump has been very active in his first sixty days introducing, suspending and threatening tariffs. A lot of the activity has been focussed on his closest neighbours, Mexico and Canada but the EU is certainly in his sights and it is widely expected that on 2 April, President Trump will announce tariffs directed at imports from the EU.

Scene-setting: the EU position

On 14 February, the European Commission (the “Commission”) issued a Statement on the US reciprocal tariff policy confirming the Commission’s view that President Trump’s proposed “reciprocal” trade policy was a step in the wrong direction. The statement noted that the EU remained committed “to an open and predictable global trading system that benefits all partners” and that it would “react firmly and immediately against unjustified barriers to free and fair trade”.

A few days later, on 18 February, the Commission issued Questions and Answers on the US reciprocal tariff policy (the “Q&A”) where it provided some key statistics on the EU / US trade relationship encompassing trade in both goods and services (in contrast to the Trump administration narrative which has been solely focussed on goods). The Q&A also responded to the surprising assertion that VAT is a discriminatory tax, confirming that VAT applies on a consumption basis to goods originating both in the EU and outside the EU. It examined some specific aspects of the trade relationship (for example the differences in tariffs imposed by the EU and the US on cars and pick-up trucks) and noted that: “The EU remains open to balanced negotiations that foster a level playing field for both sides.”

The EU’s first response to US tariffs

The first set of US tariffs that impacted EU exports to the US were the 25% tariffs on steel and aluminium announced on 10 February which took effect on 12 March. On the same day, the Commission announced countermeasures on US imports into the EU.

The Commission took a two-step approach to the countermeasures. First, it confirmed that on 1 April it will reintroduce the tariffs that were designed to respond to the US tariffs introduced by the first Trump administration in 2018. The goods that will be subject to tariffs under the first tranche of measures include motor-boats, bourbon whiskey, motorbikes and jeans.

Second, the Commission announced that a new package of countermeasures will come into force by mid-April. That second package has not yet been determined. However, the Commission has issued a 99 page list of products that could potentially be in-scope. The proposed target products include industrial (steel and aluminium, textiles, leather goods, home appliances, house tools, plastics, wood products) and agricultural products (poultry, beef, seafood, nuts, eggs, dairy, sugar and vegetables).

Before a decision is made on the mid-April countermeasures, the Commission has opened a two week consultation to gather views from interested parties (closing 26 March). The Commission will take account of that feedback when making a decision, one which must be approved by a Committee comprising a representative of each Member State.

The April tariffs were (and will be) introduced under the EU Trade Enforcement Regulation (the “Enforcement Regulation”) which allows the EU to introduce tariffs in specified situations. Although most of the situations specified in the Enforcement Regulation require input by the WTO or the adjudication of a dispute under another international trade agreement, it also permits the introduction of tariffs in response to measures taken by a trading partner.

The ability of the EU to escalate

While most of the rhetoric has focussed on the trade in goods, the EU has another legal instrument at its disposal, the Anti-Coercion Instrument (the “ACI”). The ACI provides for a comprehensive range of response measures that could be adopted by the Commission in response to coercive behaviour by a third country. It defines “coercion” broadly, and encompasses any third country measure (or threat to apply a measure) affecting trade or investment, in order to prevent or obtain the cessation, modification or adoption of a particular act by the EU or a Member State.

The range of response measures under the ACI is not limited to the imposition of tariffs on goods imported into the EU. It also allows the EU to restrict trade in services and to restrict the protection of intellectual property rights (“IP”) or the exploitation of IP in response to coercive measures taken by third countries.

The ACI is a relatively new legal instrument (it was agreed in November 2023) and has not yet been relied on by the Commission to invoke response measures. Quite how the Commission would design and enforce restrictions on the provision of services by non-EU operators, or restrictions on non-EU operators exploiting IP in the EU is as yet unclear. However, if the Commission were to investigate the use of those response measures, it could have a much more significant impact on the EU / US trade relationship than the imposition of tariffs, given that the EU buys-in more US services (EUR 427 billion) than US goods (EUR 347 billion).

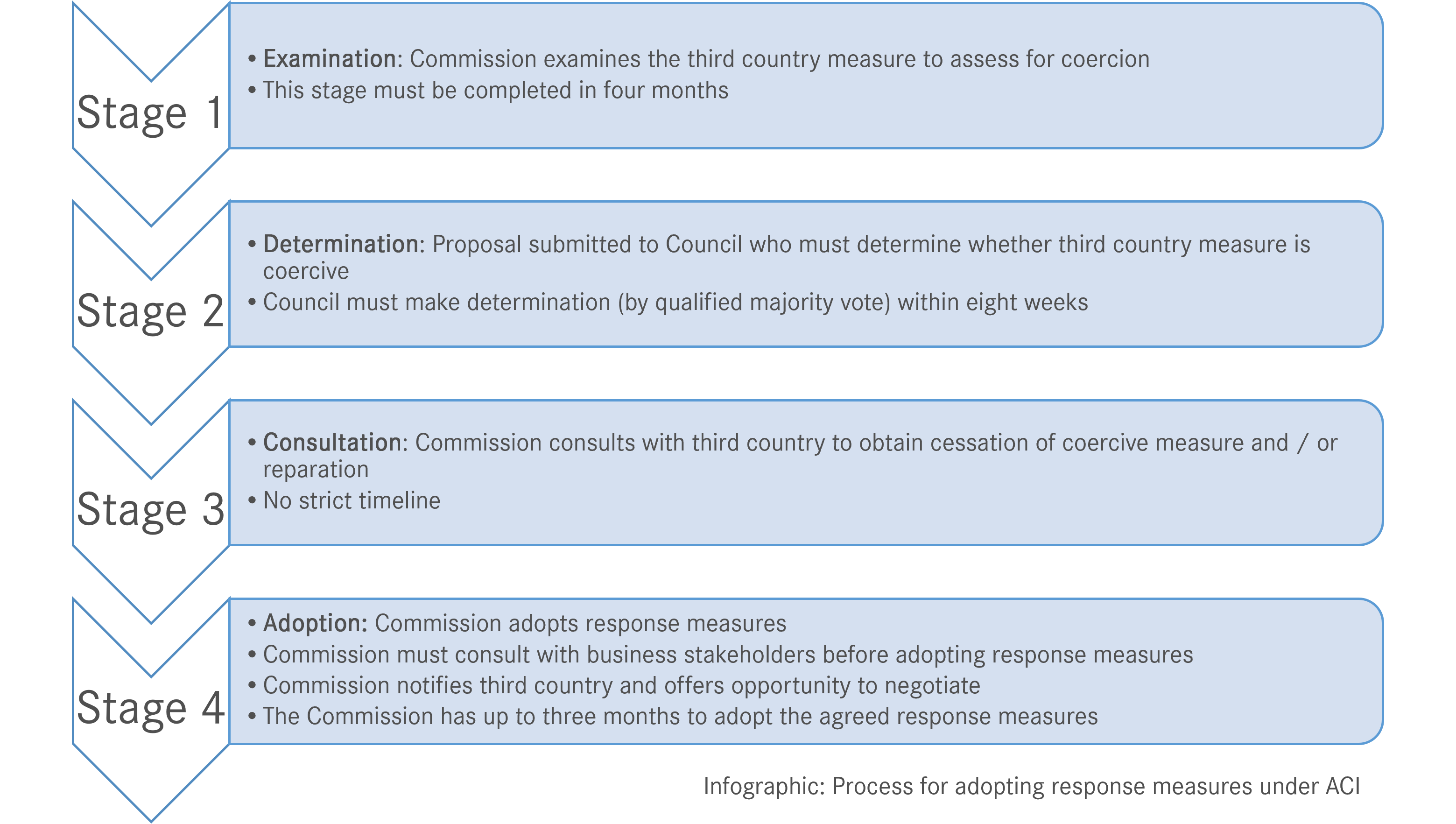

Although the ACI confers significant powers on the Commission with respect to the EU’s trading relationships, on closer examination it appears to be designed to encourage negotiation with the coercing third country. The Commission must complete a four-step process before any response measures can be adopted under the ACI, with each step extended over a number of months – in some respects recalling an addled parent counting to three before addressing bad behaviour. Based on the timelines included in the ACI, the Commission could be “counting to three” for at least nine months before any response measures come into effect.

For now, the Commission has not referenced the ACI in its public statements responding to US tariffs. However, if matters escalate, we may well see the ACI being invoked.

Impact for Ireland and businesses operating in Ireland

Businesses exporting to the US should prepare for supply chain disruptions, restrictions on market access and price fluctuations. In the immediate term, the industries most likely to be caught in the crossfire in Ireland are pharmaceuticals, medical devices, food and beverages. President Trump has been clear in his desire to see Ireland-based pharmaceutical manufacturing return to the US. There has been a significant increase in Irish exports to the US in recent months, with exports topping a record EUR 23 billion in January 2025, presumably as Irish exporters empty warehouses in Ireland to stockpile in the US in advance of any tariff announcements. Those businesses that manufacture pharmaceuticals, medical devices, food and beverages in Ireland for export to the US will be closely watching the expected US tariff announcements on 2 April.

As a first step, businesses may consider whether there are opportunities to source goods in alternative jurisdictions, or to trade with customers in new markets not subject to increased tariffs. It is clear from the recent CJEU decision of Harley-Davidson (C‑297/23) that businesses importing to the EU will not be able to avoid tariffs by simply moving production off-shore.

In a low tariff environment, the minutiae of EU customs rules have not always been comprehensively understood and applied accurately by businesses importing goods to the EU. In any new high tariff environment fresh consideration should be given to the classification and valuation of imported goods under EU customs laws, together with applicable transfer pricing methodologies, to ensure the amount of duty paid does not exceed what is legally required. Similarly, businesses should determine whether there are any special authorisations or reliefs which may be availed of in supply chains to minimise the impact of tariffs, such as customs warehousing, inward processing and outward processing.

Those operating in the services sector should be aware of the potential for disruption if the Commission opts to restrict the provision of services by non-EU business to EU customers under the ACI.

Practically, it is important to carefully review contractual arrangements and assess any potential exposure to legal action as well as any potential relief that may be available. For example, businesses should query whether the imposition of tariffs or any restriction on the provision of services is envisaged as a force majeure event in their existing contracts. Consideration should also be given to whether tariffs or restrictions on trade could constitute a ‘change in law’ or ‘change in circumstance’ under contractual agreements. In an increasingly volatile trade environment, it is important that businesses are aware of their rights and obligations and potential for recourse.

Matheson LLP’s dedicated Customs and Trade Law team helps businesses to navigate the potential impact of new US and EU tariffs. If you would like to discuss the impact that any tariffs or other trade restrictions could have for your business, please get in touch with any member of the team (Matthew Broadstock, Dara Higgins and Bernadine Dooley) or your usual Matheson contact.